Mobile technology has revolutionized numerous aspects of our lives – and one particular domain that has experienced remarkable transformations is the realm of payment methods. The advent of smartphones and the surging popularity of mobile applications have made digital wallets and mobile banking the new standard – also gaining considerable momentum in the realm of online casinos. This article will delve into the future of payments and examine how mobile technology is reshaping transactions.

The rise of digital wallets

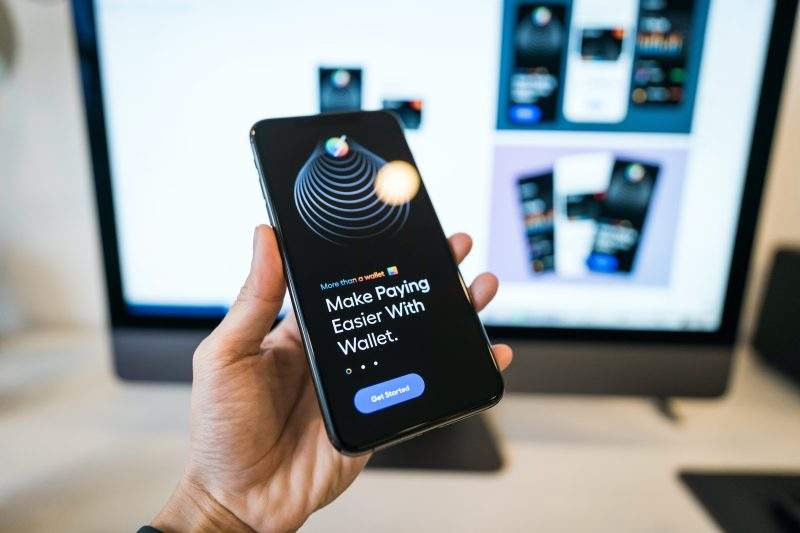

The rise of digital wallets has revolutionized the world of mobile payments. These virtual wallets allow users to securely store their payment information on their smartphones, providing a convenient and speedy way to make transactions. Whether it’s a simple tap on the phone or scanning a QR code, digital wallets have made carrying physical cards or cash a thing of the past.

One of the key advantages of digital wallets is the added layer of security they offer. With encryption and biometric authentication methods like fingerprint or facial recognition, users can rest assured that their payment information is protected. This has contributed to the widespread adoption of popular digital wallet services such as Apple Pay, Google Pay and Samsung Pay.

As more and more industries embrace mobile payments, the future of digital wallets looks promising. With advancements in technology, people can expect these virtual wallets to become even more prevalent in their daily lives. So say goodbye to bulky wallets and hello to the convenience and security of digital wallets.

Mobile banking at your fingertips

Mobile banking has transformed the way people manage their finances. With mobile banking apps, users can perform various banking tasks right from their smartphones, such as checking account balances, transferring funds, paying bills and even applying for loans.

One of the greatest advantages of mobile banking is the convenience and accessibility it offers. Gone are the days of having to physically visit a bank branch or rely on desktop computers for banking transactions. With mobile banking, users have the freedom to manage their accounts anytime and anywhere. It puts the power of financial control right at their fingertips.

What’s more, mobile banking apps are constantly evolving and improving. They now come equipped with advanced features and functionalities that enhance the overall banking experience. Some apps even go the extra mile by providing personalized financial insights and recommendations based on users’ spending habits and financial goals.

Mobile payments in the online casino landscape

Mobile payments have become extremely popular in the online casino world. With the rise of mobile casino apps and the convenience of making payments on the fly, more and more players are choosing to use mobile payments. E-wallets and mobile billing options enable players to swiftly and securely deposit funds into their casino accounts. Because of this players can now explore the best pay-by-mobile casino sites without worrying about deposits and withdrawals.

What’s also worth noting is that mobile payments provide a seamless and user-friendly experience which has opened new doors for players by allowing them to indulge in their favorite casino games whenever and wherever they want. As the online casino landscape continues to evolve, mobile payments are anticipated to play a pivotal role in shaping the industry’s future.

Security and privacy

As mobile payments become more prevalent, security and privacy concerns are of utmost importance. Mobile technology companies and financial institutions are investing heavily in ensuring the safety of mobile transactions. They use encryption, tokenization and biometric authentication to safeguard user information by providing an extra layer of security, ensuring that only authorized users can access and make payments. What’s more, mobile proxies are also gaining significant popularity.

Furthermore, mobile payment platforms employ advanced encryption techniques to protect payment data during transmission. These security measures, combined with regular security updates and user education, help safeguard mobile transactions.

Privacy is also a significant concern when it comes to mobile payments. Users want assurance that their personal and financial information is protected. Mobile payment platforms adhere to strict privacy policies and regulations, ensuring that user data is handled securely and responsibly.